Adobe’s medical plan options provide comprehensive and affordable coverage. All plans cover preventive care and provide financial protection in the event of illness or injury.

Your options

The plans available to you, based on your home address and other criteria, will appear as options on the Adobe benefits enrollment site.

You can also waive Adobe medical coverage if you have other coverage, and you’ll receive $25 from Adobe every pay period, for a total of $650 per year.

Learn more

For a detailed plan comparison, review the 2024 rewards guide [PDF]. Complete coverage details are in the plan documents.

Questions to help you choose

Does your spouse or domestic partner have coverage through an employer?

Compare per-paycheck costs for coverage and how much you’ll pay when you need care under each plan (e.g., deductible, copays, coinsurance, out-of-pocket maximum). Does it make sense for each of you to be covered separately or for both of you to be on one plan?

Will you cover a domestic partner or domestic partner’s child who does not qualify as a tax dependent?

If so, your per-pay-period contribution for coverage will be taken on an after-tax basis, and you’ll pay income tax on the imputed income [PDF] of the benefit coverage.

Are your doctors and other providers in-network?

If you’re not an Aetna member, visit the Adobe Aetna microsite to check the Open Access Choice POS II Network. In Utah, refer to the Utah Connected Network for 2023 and Aetna Extended Network for 2024. Aetna members can log in to the Aetna website (or SSO) to look up providers.

The Aetna plans allow you to see out-of-network providers, but you’ll pay more for care, and you might also receive a bill from an out-of-network provider for the difference between their charge and what your plan pays.

With the Kaiser HMO, you must use Kaiser doctors and facilities—there is no coverage for out-of-network care except in an emergency.

How are your regular prescription drugs covered?

View the Aetna covered drug list. If you’re not an Aetna member, call Aetna at 800-884-9565 if you have any questions. Aetna members can log in to the Aetna website (or SSO) for the cost of a specific drug.

If you’re not yet enrolled in Kaiser, call their preenrollment support line at 800-324-9208 to check on covered drugs and exclusions.

Want the benefits of an HSA?

Adobe’s Aetna medical plans are all compatible with a Health Savings Account (HSA). If you’re eligible and enroll in one of the Aetna plans, you can enjoy several HSA benefits.

- Triple tax advantage: There is no federal tax on contributions, interest or investment growth, or withdrawals for eligible expenses.

- No use-it-or-lose-it: Unused funds roll over year to year.

- It’s portable: You can take it with you if you change medical plans or leave Adobe.

- Contributions from Adobe: Receive an annual contribution from Adobe if you’re in the Aetna HealthSave or OOA HealthSave plan.

Interested in an Aetna medical plan, but you’re not eligible for an HSA?

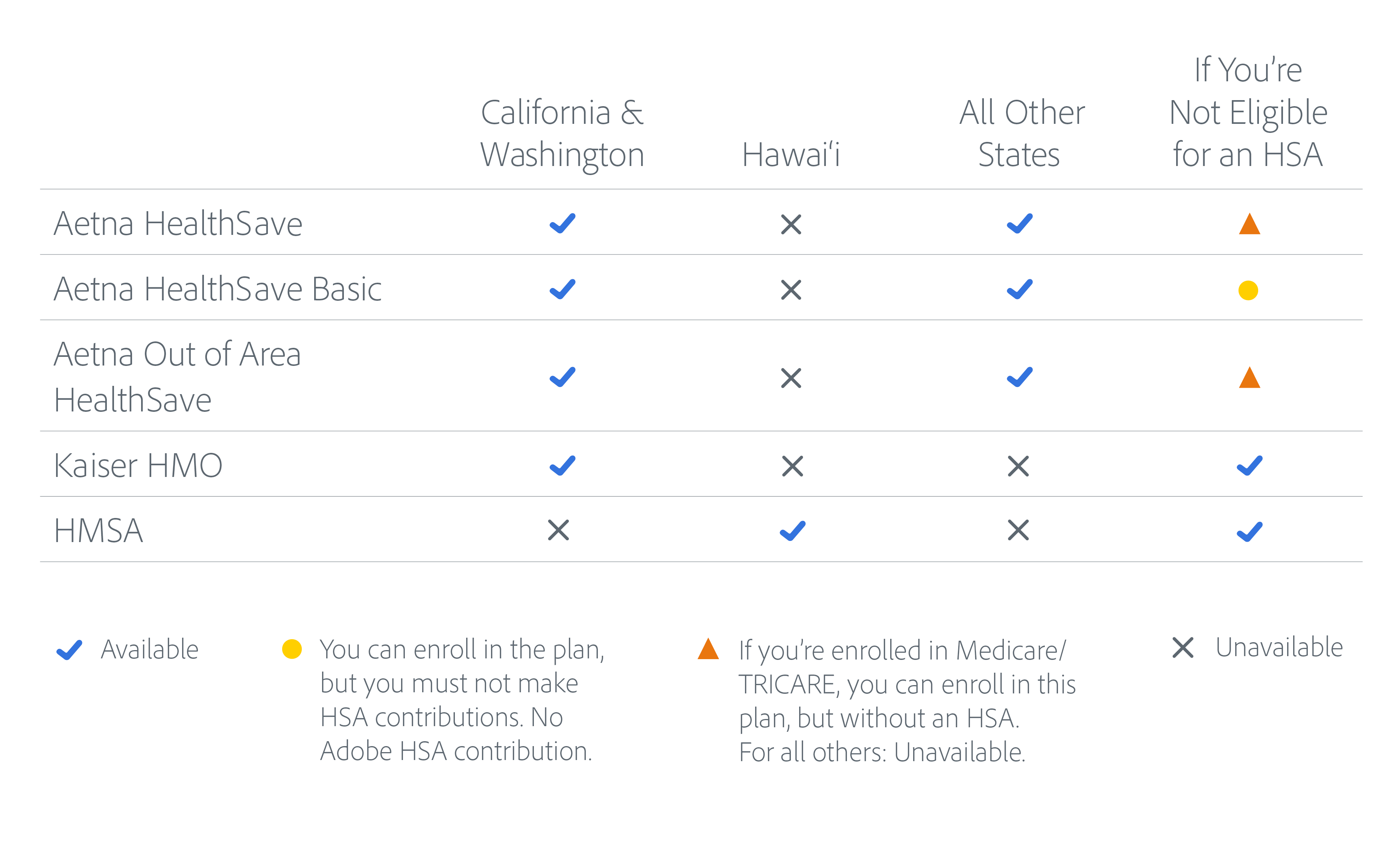

You may be able to enroll in an Aetna plan, as shown in the table above. When you visit the Adobe benefits enrollment site, you’ll be asked some questions about your HSA eligibility. The plan options presented to you will depend on your answers.

Are you considering dual coverage (being covered through Adobe and your spouse’s or parent’s plan)?

If you have dual coverage—that is, if you or your dependents are also covered under another health plan—be sure you know how Adobe’s plan and the other insurance company determine which plan will pay a claim first and whether the other policy will contribute. Read the coordination of benefits description in the plan booklets. Dual coverage does not mean double benefits!

Additionally, if are enrolled in one of Adobe’s Aetna medical plans, and your spouse’s or parent’s plan is not an HSA-qualified medical plan, dual coverage will affect your HSA eligibility.

Is help available to choose a plan?

Yes! You can get decision-making support from the Emma tool when you log in to the Adobe benefits enrollment site.

For 1:1 support, CareCounsel [PDF] can help you select a medical plan, answer general questions on how health care works, and help with claims and billing. They can also help you navigate your Medicare options. Call 833-605-6941 to speak with a member care specialist.

Confused by health care terms or how the Aetna plans work?

Refer to these quick resources: